India Form 27Q 2003-2024 free printable template

Show details

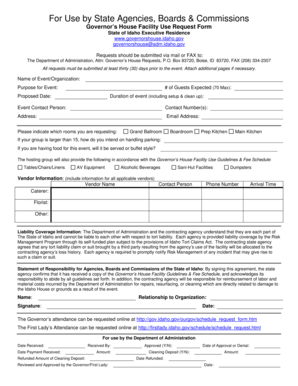

Form No. 27Q See sections 194E,195,196A×,196B,196C,196D and rule 31A and 37A Quarterly statement of deduction of tax under sub-section (3) of section 200 of I. T. Act, 1961 in respect of payments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2003 form 27q online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 form 27q online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2003 form 27q online online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2003 form 27q. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out 2003 form 27q online

How to fill out 2003 form 27q pdf?

01

Obtain the 2003 form 27q pdf from the appropriate source, such as a government website or tax agency.

02

Open the pdf file using a pdf reader or editor software on your computer or mobile device.

03

Read the instructions provided with the form carefully to understand the requirements and any specific guidelines for filling it out.

04

Begin by entering your personal information, such as your name, address, and contact details, in the designated fields.

05

Provide the necessary information regarding your tax identification number, which can vary based on your country or jurisdiction.

06

Specify the relevant financial year or period for which you are submitting the form.

07

Fill in the details of your income, deductions, and any applicable tax credits or exemptions according to the instructions provided.

08

Double-check that all the information you have entered is accurate and complete.

09

Save a copy of the filled-out form for your records, and also consider printing and keeping a hard copy.

10

Submit the completed form as directed by the tax agency or relevant authority, which may include mailing it, uploading it online, or submitting it in person.

Who needs 2003 form 27q pdf?

01

Individuals or entities that are required to report specific financial information for a particular tax year.

02

Persons who have earned income subject to withholding tax or are required to deduct tax at source.

03

Those who are responsible for deducting and depositing taxes on behalf of their clients, employees, or contractors, depending on the applicable laws and regulations of their country.

Fill 2003 27q quarterly form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 27q pdf?

Form 27Q is a document that needs to be submitted by non-resident Indians (NRIs) or foreign nationals who have earned income in India and are subject to tax deduction at source (TDS). This form is used to report details of tax deducted and deposited with regards to payments made to NRIs or foreign nationals. The PDF version of Form 27Q is the electronic copy of the form that can be filled and submitted online.

Who is required to file form 27q pdf?

Form 27Q is a tax form in India that is required to be filed by any person who is responsible for paying any income to a non-resident, not being a company, or to a foreign company. This includes individuals, firms, companies, or any other person who is making payments to non-residents.

How to fill out form 27q pdf?

To fill out a Form 27Q PDF, you will need a PDF editing software or application that allows you to edit and fill in form fields. Here are the steps to do it:

1. Open the Form 27Q PDF in your preferred PDF editing software or application.

2. Check if the form is editable. If it is, you will see form fields that are highlighted or indicated by a blinking cursor.

3. Click on the first form field you want to fill in. This can be text fields, checkboxes, or drop-down menus.

4. Type in the relevant information in the selected field. If it's a checkbox, click on it to select or deselect.

5. Continue filling out the rest of the form fields with the necessary information.

6. If there are additional pages on the PDF form, navigate to those pages and fill in the corresponding fields.

7. Double-check all the entered information to ensure accuracy.

8. Once you've completed filling out the form, save the PDF document to retain your changes.

9. If required, print a physical copy of the filled-out form for submission or record-keeping.

Note: If the Form 27Q PDF is not editable, you may need to convert it into an editable format like Word or Excel using a PDF converter tool before you can fill it out electronically.

What is the purpose of form 27q pdf?

Form 27Q (PDF) is an Indian tax form used for the reporting and deduction of taxes on payments made to Non-Resident Indians (NRI) or foreign entities. The purpose of Form 27Q is to facilitate the collection of tax at the source from NRIs or foreign entities receiving income in India. It includes details of the payments made and the tax deducted at source (TDS) by the payer. This form is filed by the person or entity making the payment to the NRI/foreign entity.

What information must be reported on form 27q pdf?

Form 27Q is an Indian tax form used for the reporting of tax deducted at source (TDS) for payments made to non-residents. The following information must be reported on Form 27Q:

1. Tax Deducted and Deposited: The form requires the reporting of details regarding the tax deducted at source (TDS) from the payments made to non-residents as per the provisions of the Income Tax Act.

2. Pan Number and Address: The Permanent Account Number (PAN) of the deductor (person making the payment) and the non-resident payee must be provided in the form. The address of the deductor and the payee's non-resident status must also be mentioned.

3. Nature of Remittance: The form requires information regarding the nature of the remittance made to the non-resident. This includes details of whether the payment is for interest, royalty, dividends, fees for technical services, etc.

4. Amount Paid/credited: The form requires reporting of the total amount paid or credited to the non-resident during the relevant period. This includes the gross amount of payment, amount of TDS, as well as any tax collected at source (TCS) if applicable.

5. Payments Exempt from TDS: If any payments made to the non-resident are exempt from tax deduction at source, the details of such payments must be reported on the form.

6. Rate and Amount of Tax Deducted: The form requires reporting of the rate of TDS applied on the payments made to the non-resident, as well as the corresponding amount of tax deducted at source.

7. Certificates from Assessing Officer: If the non-resident has obtained a certificate from the Assessing Officer for lower or nil deduction of TDS, the details of such certificate must be mentioned on the form.

8. Details of Challans: The form requires reporting of the details of challans deposited for each payment made to the non-resident.

These are some of the key information that must be reported on Form 27Q. It is important to note that the form may require additional information depending on the specific circumstances and nature of the transaction.

When is the deadline to file form 27q pdf in 2023?

The deadline to file Form 27Q in PDF format for the year 2023 has not been specified. The deadline for filing Form 27Q typically depends on the specific quarter in which the tax was deducted. It is recommended to refer to the official website of the Indian Income Tax Department or consult a tax professional for the most up-to-date information regarding deadlines for filing Form 27Q in 2023.

What is the penalty for the late filing of form 27q pdf?

The penalty for the late filing of Form 27Q PDF, which is a tax withholding statement for non-resident taxpayers, is prescribed under Section 234E of the Income Tax Act, 1961. As per the law, a penalty of ₹200 per day is levied for each day of delay until the statement is filed, subject to a maximum penalty amount not exceeding the total amount of tax deductible.

How can I send 2003 form 27q online for eSignature?

Once your 2003 form 27q is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find 2003 form 27q search?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 2003 form 27q sample and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the 2003 form 27q pdf in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2003 27q statement form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your 2003 form 27q online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Form 27q Search is not the form you're looking for?Search for another form here.

Keywords relevant to 2003 form 27q quarterly

Related to 2003 form 27q make

If you believe that this page should be taken down, please follow our DMCA take down process

here

.